The financial accounting in the game seems fairly advanced. And yet, the general opinion seems to be that the financial reports (FINIS, FINBS) are not useful, and should not even be taken seriously. Which is bizarre, because as far as I can tell they are accurate, and in a game where you are managing a company, how can your financial statements be useful to no one?

I think a big part of this stems from the fact that when we produce items, they are assigned a value of zero. Note that when we buy items, they are assigned the value we paid for them. This is the only scenario in which zero value items occurs, as far as I can tell: we cannot sell anything at zero, and even our starting package items are given some value.

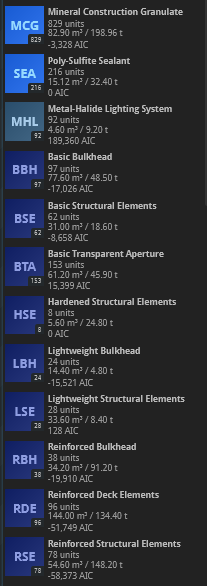

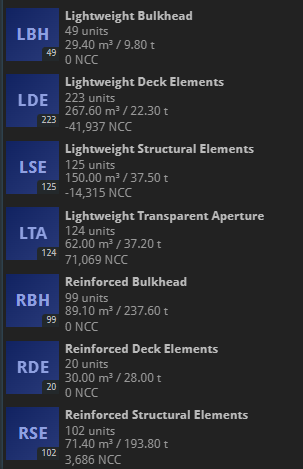

This leads to strange scenarios: Imagine my buddy and I buy the inputs and consumables at identical prices in order to produce some BSE & MCG at our identical bases. I produce 12 BSE, and my buddy produces 12 BSE. Then my buddy sells me his 12 BSE for exactly the cost it took him to produce… the game would say my (now) 24 BSE are worth half what it actually took to produce them since it averaged my zero cost 12 with his full cost 12.

Or, if before I buy my buddy’s BSE, I construct a RIG. Since the BSE & MCG were self-produced and valued at 0, my RIG has a book value of 0 as well. Then I buy my buddy’s BSE & MCG, again at cost, and construct a second RIG. This one will have a book value equal to the production cost, even tho they actually took exactly the same costs to produce.

I spend the next week producing as many BSE as I can. All are worth zero, and my expenses for the week are enormous: the value of all the inputs and consumables go straight to negatively hit my bottom line. I show a huge loss, and (according to my books) have absolutely nothing to show for it. My inventory is worth nothing.

But the next week, I sell all of them. I post enormous revenue, and zero expenses. What a windfall for my company!

Meanwhile, if instead my buddy produced the BSE, and I just bought them at cost as they were ready the first week, my income statement would be neutral. My balance sheet would show a transfer from cash to inventory. At the end of the period, I would show neither loss nor profit, since I had in effect done nothing to actually realize a loss or gain yet.

When I sell the BSE next week, however, I will then show revenue according to the price I can get for the goods, and an expense according to the value of the inventory sold off. The profit or loss will be exactly equal to the difference in sale and purchase price of the goods, which is actually the values I want to see.

I propose that items we produce be priced as the sum of the inputs’ values and the (pro-rated) value of the consumables consumed during production.

Input values we already have.

The value of the consumed consumables we have as well: each facility has worker requirements, and at least some consumables were consumed for any production to have occurred. The value to assign for each consumable consumed to support the facility is then:

rate of consumption (units/time) * production duration * consumable value.

I believe this change will produce the following benefits:

- The value on each item in your inventory is your actual break even point, externalities like shipping notwithstanding. By selling the item for that amount, you will recover the cash you directly expensed to obtain it in the first place (currency adjusted). Always.

- Your Inventory line on FINBS is, similarly, the amount you need to recover upon sale to show any profit. Our inventory is our primary asset, the exploitation of it our primary source of profit. It should directly reflect this fact.

- Your actual gross margin for a period is directly calculatable from FINIS: Material Sales - Materials Delivered = exactly how much more you received than you expended for goods sold this period.

- Your Result period to period will reflect your total economic activity that period, and not the mix of selling self-produced vs purchased items. Delays between production and sale will be less noticable on FINIS.

- Your Base Sections line on FINBS will derive from the actual amounts you directly spent to obtain the component parts, and not just the ones you bought.

- Similarly, the Depreciation of Buildings expense line on FINIS will be the true loss incurred that period (according to whatever formula is currently being used here, but at least the base value is not arbitrarily lower if you self-produce and prefabs).

- The Worker Supplies expense line on FINIS will reveal how much you lost due to blocked facilities and cancelled orders wasting consumables.

- Similarly for Material Consumption and the waste of inputs.

To realize this change will require some additional transactions, which I detail below.

Implementation Details

To my best understanding, the current system works as follows:

- When consumables are consumed for any reason (i.e. removed from your inventory), their value is deducted from Inventory on the balance sheet (FINBS) and added to your Worker Supplies expense line on the Income Statement (FINIS).

- When you start production, the inputs’ values are deducted from Inventory, and added to your Material Consumption expense line.

- When production finishes, nothing happens. Ostensibly, the outputs’ zero value is added to Inventory.

- When the produced goods are sold, the proceeds increment Material Sales (FINIS) & Cash (FINBS), and decrement Inventory (FINBS) & increment expense line Materials Delivered (FINIS). If its just self-produced goods, the change to Inventory & Materials Delivered is zero, of course.

One way to implement my proposed change follows.

I add a “Materials in Progress” balance sheet account (Current Asset), but you could get away with just using Worker’s Supplies and Material Consumption as now, and moving the values to Inventory at output creation. I think a FINBS line to catch this currently unrecognized asset is more elegant, but it is not necessary.

In the current scheme, there are no recorded financial impacts due to facility stoppage, but if we are to capitalize only the consumption actually producing the goods there will need to be:

- When consumables are consumed, their value is deducted from Inventory and added to Materials in Progress. These values need to be tracked by each facility generating the consumption. This is already done to produce each facility’s efficiency figure, now there is also a consumable value to track with it.

- When you start production, the inputs’ values are deducted from Inventory, and added to Materials in Progress.

- When production finishes, the value of the outputs (i.e. the sum of the inputs & the pro-rated consumables) is deducted from Materials in Progress and added to Inventory.

- When a facility is blocked for any reason other than lack of consumables, or consumables are consumed while blocked, deduct the facility’s remaining consumable value from Materials in Progress and add to Worker Supplies.

- When a facility ceases being blocked, deduct its remaining consumable value from Worker Supplies and add to Materials in Progress.

- When production finishes, deduct from Materials in Progress and add to Inventory, the value being split across the outputs.

- When a production order is cancelled, process any successful outputs as above, move any residual consumable consumed value so far from Materials in Progress to Worker’s Supplies, the value for any returned inputs to Inventory, and the value for any non-returned inputs to Material Consumption.

- When the produced goods are sold, same as before: the proceeds increment Material Sales (FINIS) & Cash (FINBS), and the cost of goods sold decrement Inventory (FINBS) & increment expense line Materials Delivered (FINIS).

I believe this covers all new transactions.

People talk about the absolute necessity to use external spreadsheets to calculate your costs to produce. For basic cases, or even as a sanity check, the game could provide this information instead of divorcing it from the inventory.

I hope this resonates with you. I’d love to hear what people think.

). I’m mostly wondering if you see the value in this, and when it might get attention.

). I’m mostly wondering if you see the value in this, and when it might get attention.