To make penny wars pointless, trade events should be closer to production events or there should be more buyers or sellers in any given market. Any minimum tick rule changes is simply putting a bandaid on the issue.

I disagree. Tick sizes are healthy to the liquidity of the market, regardless of how many participants there are in it. There is a reason why the S&P500 or various other stocks trade at certain tick sizes. ES! futures trade at a 25 cent tick size for the S&P E-mini’s. This is to discourage this exact penny frontrunning and promote people piling up liquidity.

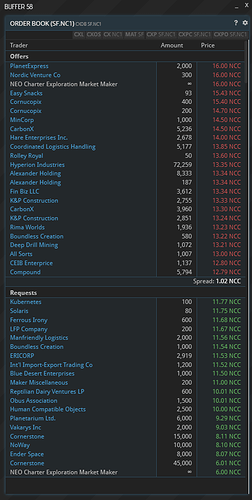

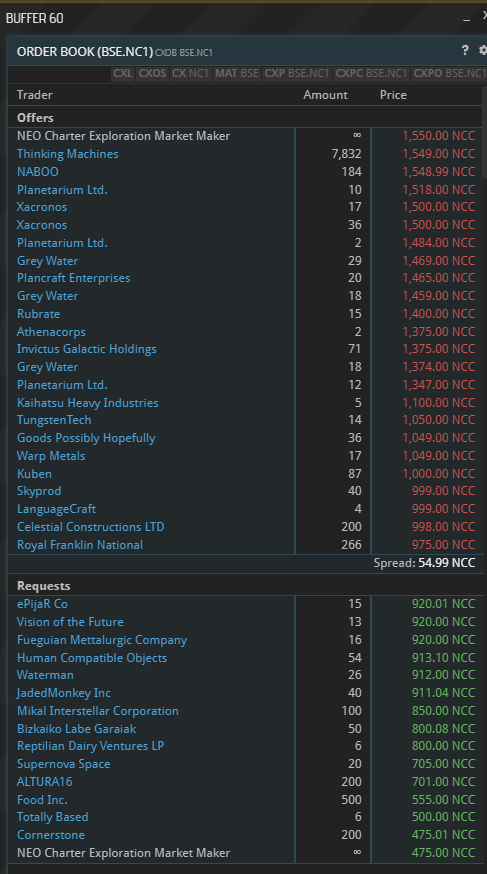

The issue here, and Molp has the correct idea IMO, is that frontrunning someone’s BSE order at 1400\ea with yours at 1399.99 is just annoying. You can’t sacrificing any meaningful economic value simply to be first in line. Tick size adjustments mean you must sacrifice meaningful economic value (1390 for example) to be able to be first. Otherwise you’re just having wars with people to be “first” which is not fun.

Trading or listing fees also create these incentives, but they create a deadweight loss (taxes that get black-hole’d), along with requiring sellers to post currency collateral which is not a good idea. If you use tick sizes to control the markets, then other players capture that “loss” by getting better prices for items they’re exchanging.

Molp suggested 4 sig-fig tick sizes, I think that’s too fine. I think it should be 3 sig figs. One of the healthiest markets, SF, operates usually around this 3 sigfig mark. And we see a very healthy distribution of liquidity across a broad range of prices. And even then there are still jumps and gaps.

Your perception is wrong, it explicitly does have an impact to available liquidity and the health of the market. There is a specific reason why the equity, bond and other markets have specific tick sizes. This is different than a stock split which is used to keep the overall price of a share at some nominal value (typically $10-1000).

The really quick summary is this. If there are very small tick sizes, everyone who is posting offers is cluttered directly around each other. They’re all at some tiny variation of each other, rushing to front-run the next. There is very little liquidity deeper into the book because why would you post it behind everyone? You’re the last to get filled and thus, the time-cost of money and opportunity cost and all that shit.

With enforced tick-sizes, you force-spread out the offers across a broader range of prices. There is now t he same amount of orders, but they are at a greater distribution of prices and it’s not a pennyrace to see who is first. This also has other incentives to people taking liquidity and how deep they will place an order and the value these deeper orders form the spread present.

This is actually the worst thing you could possibly do to the market.

In theory yes, everyone is equal.

But in practice, this will mean the bid\ask spread will never collapse on markets. Nobody will have any incentive to close it. They just place their order with everyone else to capture the maximum possible price.

It will destroy the health of the markets and orderbooks.